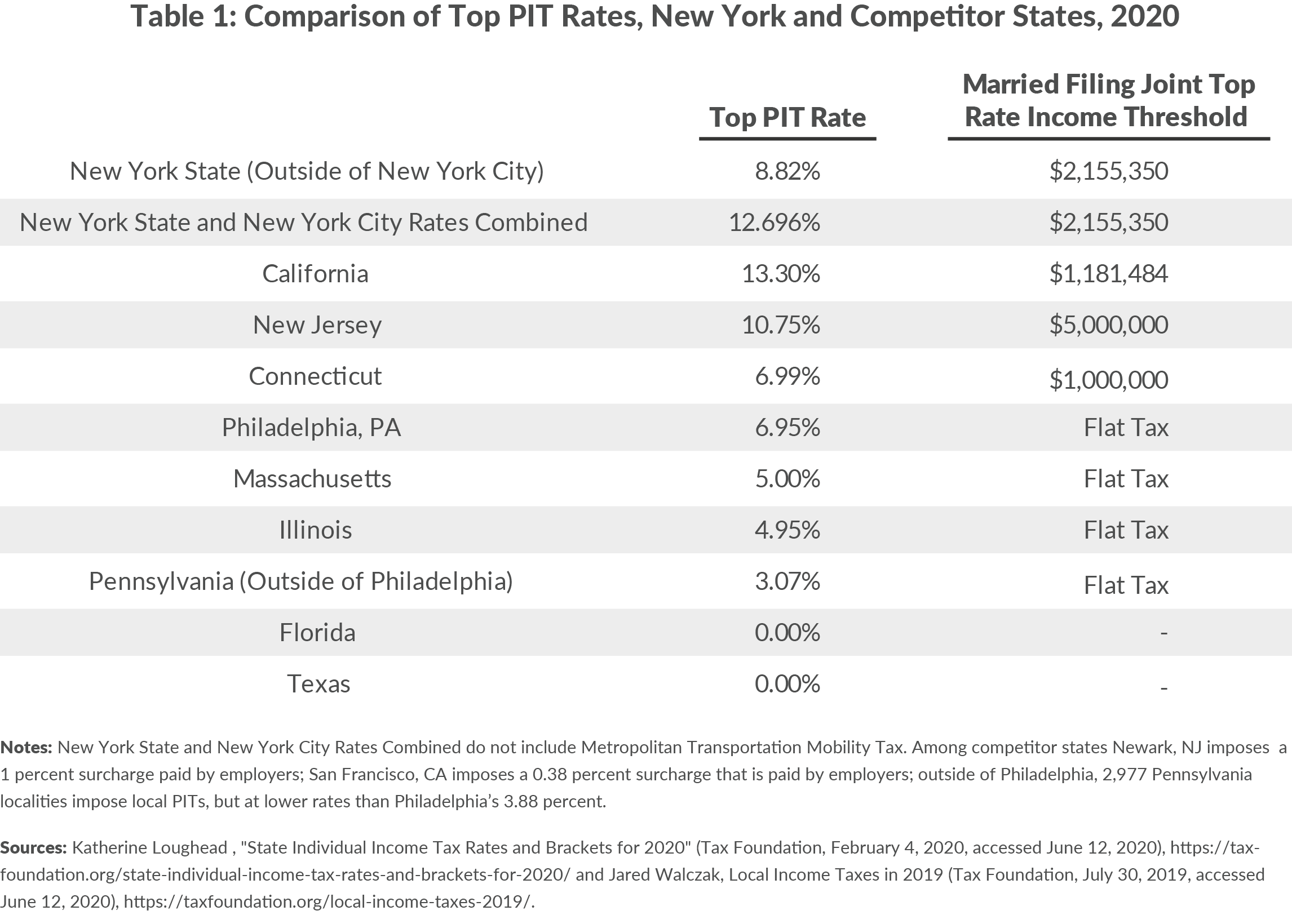

Is the burden of taxation in the Empire State becoming too heavy to bear? New York City residents face a unique financial reality, shouldering not only state income taxes but also a local income tax, a combination not commonly found across the United States. This dual taxation system adds a layer of complexity to financial planning, demanding a thorough understanding of both state and city tax obligations.

The landscape of taxation in New York City is a complex one, particularly for its residents. The city's income tax, a critical aspect of the financial obligations for those living within its limits, further complicates the financial picture when combined with the state income tax. The intricacies of these tax systems require diligent attention from taxpayers in order to remain compliant.

To better understand the specifics, let's delve deeper into the components that shape the overall tax burden, focusing on how these two taxes, state and local, interplay, and how they impact the financial lives of those who call New York City home. We will also clarify the implications for tax planning and strategies that may help taxpayers effectively manage these financial obligations. Let us begin our exploration by examining the unique blend of financial duties imposed on New York City residents, where income taxation is multi-faceted.

In New York City, the imposition of local income taxes is a pivotal aspect of financial management for its residents, adding another layer of intricacy to the state's financial landscape. The rates, which vary based on an individual's earnings, highlight the progressive structure of taxation employed in the city. These rates currently span from 3.078% to 3.876% of taxable income, underscoring the graduated system where higher incomes encounter comparatively higher rates. This local tax, obligatory for all city inhabitants, operates concurrently with New York's state income tax. Taxpayers must remit their obligations annually, integrating the city tax alongside state and federal tax submissions.

For those navigating the tax complexities, understanding the differences between the New York City and New York State income taxes is fundamental to accurately filing and ensuring compliance. While both levies are tied to an individual's earnings, the nuances differ across how these taxes apply and are calculated. It is important to acknowledge that both taxes are levied on income, but they are applied to various demographics with distinct regulations.

Electronic filing, available when it is an option, is the preferred method for submitting your return, offering both efficiency and a higher level of security. The state has made advancements in withholding tax and wage reporting applications, which are currently accessible. For those looking ahead to future tax planning, the 2025 tax rates and thresholds are already integrated into the New York tax calculator, which is readily available to provide estimates for future tax obligations.

Taxpayers should be aware of several key considerations. First, for the most current tax information, it is advised to utilize the New York State Tax Calculator for 2025/26. The tool employs the latest federal and state tax tables, providing accurate estimations. When estimating your taxes for 2025/26, select the 2025 tax year to ensure youre using the most up-to-date information.

Second, the tax brackets are critical for understanding your potential tax liability. The New York income tax is structured around nine tax brackets, with the highest marginal income tax reaching 10.900% as of 2025. You can find detailed information on these rates and brackets on the official state tax website.

Third, taxpayers should familiarize themselves with the eligibility for IRS Direct File and New York State Direct File. This allows eligible New Yorkers to file their federal returns and seamlessly transfer information to complete their state returns. These services are accessible via smartphone, laptop, tablet, or desktop computer, streamlining the filing process.

In order to illustrate the details of New York City and New York State taxes more effectively, let's summarize key elements in a table:

| Tax Type | Description | Applicability | Rates/Brackets | Filing Resources |

|---|---|---|---|---|

| New York City Income Tax | Local tax on income, collected by the NYS Department of Taxation and Finance. | Residents of New York City | Progressive rates from 3.078% to 3.876%, based on income. | New York State Department of Taxation and Finance Website |

| New York State Income Tax | Tax on income at the state level. | Residents of New York State who meet filing requirements. | Progressive rates ranging from 4% to 10.9%, based on income and filing status. | New York State Department of Taxation and Finance Website, IRS Direct File (for federal), and New York State Direct File (for state) |

| Federal Income Tax | Tax on income at the federal level. | U.S. Citizens and Residents who meet filing requirements. | Progressive rates based on income and filing status. | IRS.gov, IRS Direct File (for federal), and Tax Software |